Renewable Energy-Driven Data Centers: Shaping Mexico’s Digital Future

The surge in electricity demand from data centers is reshaping investment priorities: access to renewable, cost-competitive, and scalable power is no longer an advantage; it has become a prerequisite for operating in Mexico.

Today, Mexico stands as Latin America’s second-largest data center market after Brazil, with 350 MW of installed operating capacity and a project pipeline poised to elevate that figure to 704 MW over the coming years.

The sector’s expansion is being propelled by digital nearshoring, emerging technologies, and heightened storage requirements. The Mexican Data Center Association projects that by 2029, data centers will contribute 5.2% of Mexico’s GDP ($73.536 billion), including multiplier effects across telecommunications, cloud services, specialized employment, and technological modernization.

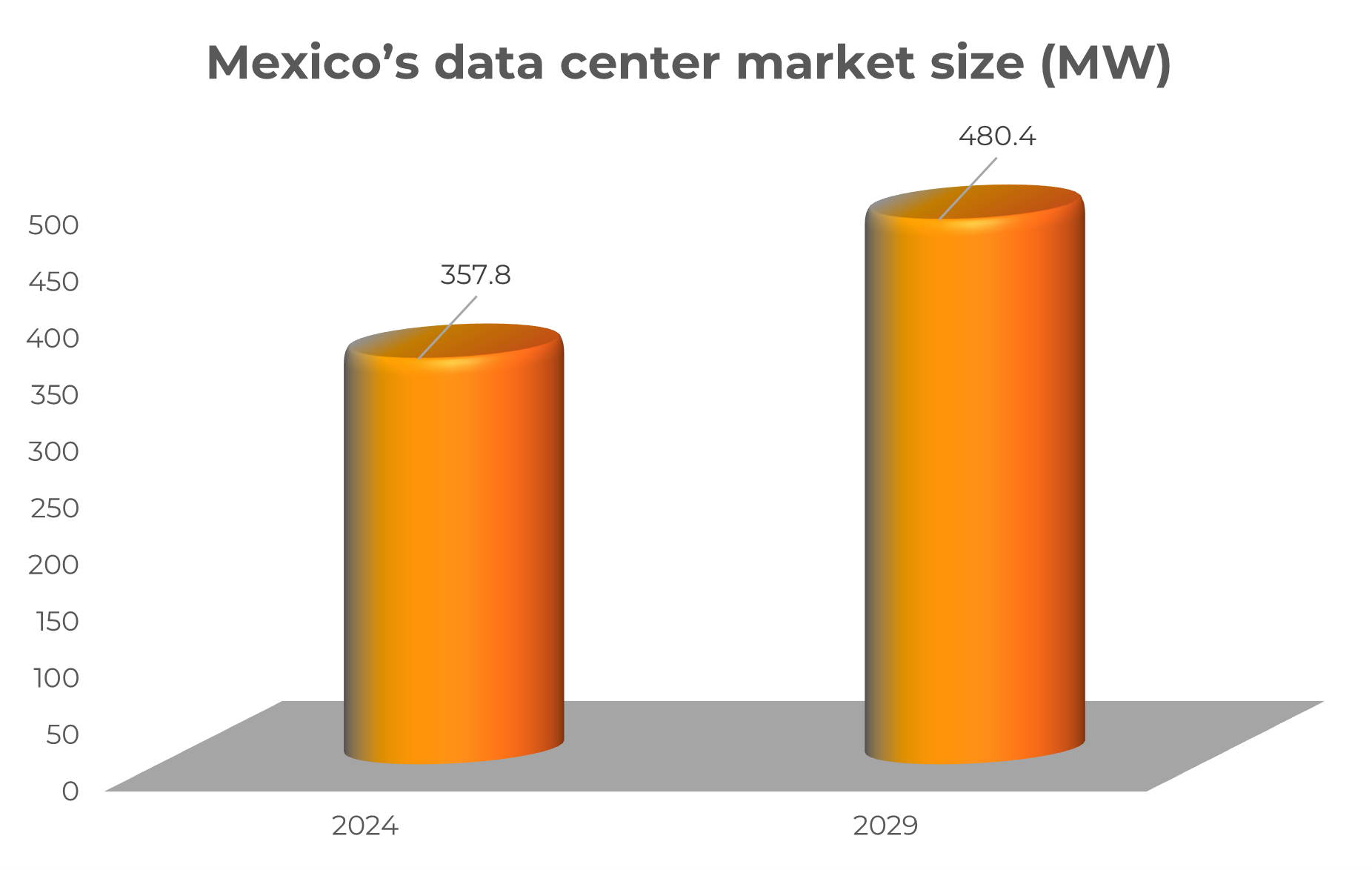

Research and Markets anticipates capital investment in Mexican data centers will climb from $1.06 billion in 2024 to $2.27 billion in 2030—a compound annual growth rate of 13.53%. Other forecasts paint an even more optimistic picture: Mordor Intelligence estimates the Mexican data center market at approximately 357.8 MW in 2024, requiring $4.590 billion in investment, and projects growth to 480.4 MW by 2029 (a 6.07% CAGR), with investment rising 7.71% to $6.656 billion that year.

Source: https://www.mordorintelligence.com/es/industry-reports/mexico-data-center-market

A substantial portion of this capacity is concentrated in Querétaro, which currently hosts two-thirds of the nation’s infrastructure, providing 230 MW of operating capacity. Low seismic risk, robust fiber-optic connectivity, and political stability have solidified its position as the country’s primary hub.

Amazon Web Services‘ planned $5 billion investment complements an established ecosystem that includes KIO Networks, Microsoft, Oracle, and Google. The state government has also allocated $300 million to strengthen the local power grid.

Other regions are developing concurrently. Monterrey, for instance, leverages industrial infrastructure, proximity to the United States, and technical talent, attracting operators such as Equinix. Meanwhile, emerging clusters in Guadalajara and the Bajío are gaining traction, supported by specialized events like the 2024 Data Center Summit.

The Mexican Data Center Association estimates that 18 new projects will attract $8.5 billion in investment over the next decade. Yet this boom confronts a significant obstacle: power supply. Data centers consume electricity voraciously; without reliable, continuous, and affordable energy sources, expansion plans risk stalling. Renewable energy has consequently emerged as a strategic enabler for sustaining this growth.

Data Center Energy Intensity: Who Will Power the Growth?

Data centers face a critical dilemma that could determine their digital future: while their power consumption is escalating rapidly, the availability of clean, sustainable sources has not kept pace. This energy gap is becoming the most critical constraint to sector expansion.

In 2024, global data center consumption reached 415 TWh—approximately 1.5% of total electricity demand. The International Energy Agency (IEA) projects usage will more than double to exceed 945 TWh by 2030, slightly surpassing Japan’s current total electricity consumption.

This surge, driven by the proliferation of artificial intelligence, cloud computing, connected device storage, and industrial automation, is dramatically increasing power demand. Ideally, that electricity should originate from renewables—not only to reduce long-term operating costs but also to minimize environmental impact relative to fossil fuel sources.

According to the IEA, renewables—primarily solar and wind—already supply 27% of data center electricity, with that share expected to reach 50% by 2030.

This trajectory mirrors global generation trends. In 2024, renewables accounted for 32% of the world’s electricity, surpassing the previous record of 30% set in 2023. The addition of 585 GW of capacity—451.9 GW of which was solar—brought global installed renewable capacity to 4,448 GW.

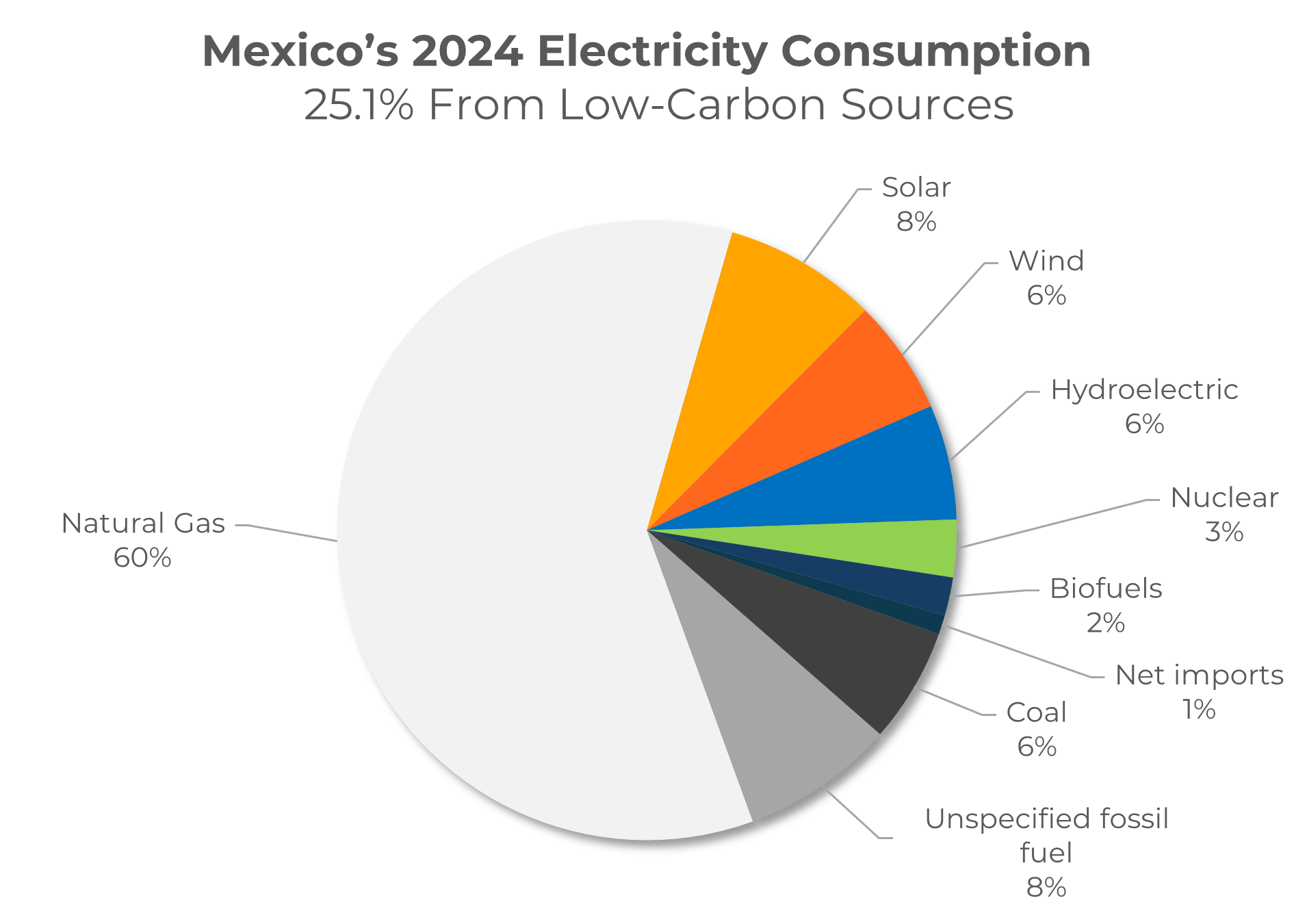

Domestically, one of the primary barriers to data center growth in Mexico is the limited availability of renewable sources in the national power mix. More than two-thirds of Mexico’s electricity is generated from fossil fuels, with natural gas alone accounting for approximately 60%. This reality complicates access to clean power for technology companies with global carbon-neutral commitments that aim to operate entirely on renewable energy.

Source: https://lowcarbonpower.org/es/region/M%C3%A9xico

The existing power infrastructure is not yet fully aligned with this demand. Consequently, many companies resort to alternatives, such as clean energy certificates (CELs) or self-supply arrangements, to meet ESG standards without compromising their operations.

Change, however, is underway. The Federal Electricity Commission (CFE) has announced $23.4 billion in investment through 2030 to strengthen generation, transmission, and distribution, with strong emphasis on renewables. During the current six-year presidential term, installed capacity is scheduled to increase by 29,074 MW, of which private investors—primarily in clean technologies—will contribute 6,400 MW.

This energy transition paradigm creates new opportunities. As renewable infrastructure expands, the industry—and data centers in particular—will gain access to more competitive, sustainable, and reliable electricity contracts.

Smart Sourcing Strategies: The Pivotal Role of Clean PPAs

One of the most effective approaches to securing clean, stable, and predictable power is through renewable power purchase agreements (PPAs). Technology companies operating data centers already represent more than 30% of global corporate PPA renewable capacity, reflecting a clear preference for contracts that deliver cost stability, traceability, and supply reliability—attributes that renewables can provide.

Atlas Renewable Energy is a regional leader in this model. With an asset base of more than 8 GW in different stages, including advanced development, construction, and operation, the company has structured long-term agreements across multiple sectors, including data centers.

In late 2024, Atlas announced construction of the 579 MWp Draco Solar plant in Brazil to supply V.tal and other industries. In 2025, it signed an agreement to provide ODATA’s Chilean data centers with 100% renewable power, certified under the International Renewable Energy Certificate (I-REC) standard.

Atlas Renewable Energy has also recently commissioned its Desert BESS project—the largest standalone battery system in Latin America—combining a 200 MW solar plant with 800 MWh of storage. The facility can deliver clean, consistent power for up to four consecutive hours, contributing 280 GWh annually.

Under this megaproject, Atlas will supply EMOAC (a Copec subsidiary) with clean energy for 15 years, with some energy designated for electric public transportation, enabling approximately 2,500 e-buses and more than 27 charging stations. Another PPA will provide CODELCO, Chile’s state mining company, with 375 GWh per year of clean power from 2026 for 15 years.

By integrating renewable generation, battery storage, and long-term contracts, Atlas Renewable Energy demonstrates how data centers can drive energy innovation. From adopting clean backup technologies to deploying AI for load optimization, these facilities are elevating efficiency and sustainability standards across Latin America.

Given the exponential growth of data centers, the central question is how to secure electricity that is both competitive and low-carbon, while remaining dependable. Renewables, enabled through storage-backed PPAs, provide the solution most aligned with global decarbonization, operational efficiency, and ESG objectives. Players such as Atlas are positioning the region not merely as a destination for digital investment, but as a benchmark for resilient, clean energy infrastructure.

Energy as Strategy—Data Centers at a New Frontier

Mexico is consolidating its digital leadership, but future competitiveness will depend on more than connectivity and installed capacity. In a sector where uptime and energy efficiency are paramount, stable access to clean, reliable, and scalable power becomes a business imperative.

The energy transition is not a peripheral challenge; it represents the new structural foundation of data center development. Renewable PPAs with storage—already implemented in Latin America by companies like Atlas Renewable Energy—demonstrate that digital growth need not compromise carbon targets or operating costs.

Investing today in intelligent energy infrastructure represents a strategic bet on the resilience, traceability, and competitive positioning of data centers in an increasingly demanding marketplace—and Mexico possesses all the essential elements to succeed.

At Atlas Renewable Energy, we have a WhatsApp channel ready to assist you. Through it, you can get quick answers to your questions. Contact us and discover how easy it is to connect with us!

This article was created in partnership with Castleberry Media. At Castleberry Media, we are dedicated to environmental sustainability. By purchasing carbon certificates for tree planting, we actively combat deforestation and offset our CO₂ emissions threefold.

Share This Entry